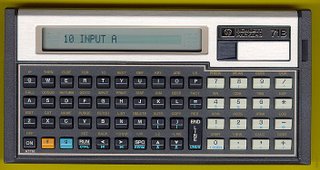

I was able to upload my portfolio today to Robert Haugen's 71 parameter model.

Haugen Custom Fiancial Systems, Inc.

I liked the asnwer, so it must be right (LOL). It said that my portfolio of 27 stocks was expected to outperform the S&P 500 by 4.7%. It doesn't give detail, such as which stocks are the dogs and which are the good ones. I suppose you could run multiple portfolios and remove a stock at a time to kind of rank them, but frankly that sounds like too much work.

"Calculate Your Portfolio's Expected Return

Your Portfolio's Annualized Expected Return Relative to the Expected Return on the SP500: 4.71%"

I was thinking on my way to work this morning about my analysis of the 10 or so MFI stocks recently and then my selection. One item that puzzled me at the time was that some of the stocks (VTRU & FTD for example) were loaded with debt. People are taught that debt is bad, debt is evil. So how were these stocks on the list and was I right to "run away"? Good questions.

Here is my logical answer. Comments welcomed.

- Debt is not necessarily evil.

- Companies need to raise $ to expand, they can do it (1) via debt or (2) via stock.

- As a stockholder, you would prefer debt over stock so long as it is manageable as additional stock dilutes your holdings.

- So the real question is can the company earn a greater return on the funds it borrows than the interest rate and pay down the debt?

When I thought about it this way, I got a lot more comfort with these high debt companies. Yes they are leveraged. Yes they could have trouble servicing the debt if their business goes into a tailspin. But remember, the MFI excels at identifying "good" companies. These are the types of firms that should be able to pay their debt and have historically had $ left for you and me, the stockholders. As an added bonus, as they pay down the debt, that is even more income above the high earnings yield already for you and me. Hooray!

So "the bottom line" (to borrow a Cramer catch phrase), do look at the debt... but also look at the cash flow of the company and their ability to service the debt.

Now I'd like to vent a little bit about OVTI. They had very solid numbers last night, yet the stock tanked about 12.5% today. Here are what the "experts" are saying:

"Baird analyst Tristan Gerra, who has a "Neutral" rating on the stock, said there are signs of growing inventory in China, and predicted the company could get nipped by pressure on pricing and margins.

"Reading beyond the reported numbers, Omnivision's April-quarter performance suggests further market-share loss in mobile phones, significant inventory accumulation of sensors in China, and no meaningful second-half momentum expected for 1.3 megapixel sensors, removing hopes of a significant mix improvement," Gerra wrote in a note.

Gerra also noted that "heavy insider selling continues and is in contrast with the positive outlook management is casting for the second half.""

********************************************************************************

Needham analyst Quinn Bolton, who has a "Hold" rating on the stock, also suggested pricing and margin concerns could continue to hang over the stock. "We believe concerns regarding pricing pressure, margin compression and the sustainability of VGA sensor demand in Asia may weigh on the shares," Bolton wrote in a research note. "Were these concerns to prove accurate, we would likely have to lower our forward estimates."

********************************************************************************

Morgan Keegan analyst Harsh Kumar was of a different opinion. He reiterated an "Outperform" rating on the stock and said that the company may be on the verge of a growth spurt.

"We feel that the company has tremendous growth potential as it is just beginning to broach the notebook, automotive and medical markets. That, coupled with the growing penetration of camera phones in the emerging markets, makes us comfortable with OmniVision's growth prospects," Kumar said in a note.

**********************************************************************************

Finally the WSJ:

OmniVision Technologies shares fell 3.40, or 12.7%, to 23.41 after the company issued a first-quarter forecast below Wall Street estimates. Omnivision said it expects first-quarter per-share earnings of 27 cents to 34 cents, or 38 cents to 43 cents on a pro forma basis, with revenue of $135 million to $145 million.

Frankly, I didn't know what to make of all the noise. I don't think the 1st qtr forecast was below "expectations", rather it is FASB 103, the expensing of options that is the issue. These high-tech companies are always under the gun on margins, but this is a high growth market and OVTI seems to be well-run. I'm not losing any sleep and fully expect OVTI to move back towards $30.

The comment about insider selling did perk my interest. It is true that there has been regular insider selling. But if you scroll back, (Insider OVTI) there was a bunch of insider selling a year ago a $13 a share. If you sold based upon that, you missed a double.

1 comment:

Regarding debt: A bit a debt (or more) on the balance sheet has a similar effect as leverage does on your portfolio. Rather than equating debt=bad and cash=good maybe we should think in terms of a companies ability to service their debt and what their using their debt for.

Post a Comment