Let's Get Ready to Rumble!!!!!! I like Jim Cramer. I find his show entertaining, a guilty pleasure. I have bought some stocks based upon his recommendations and have actually done quite well. He has had some big misses lately, as I recall UNH was his best stock pick for 2006. MO was his best Dow pick for 2006. I suspect he has already changed his mind.

Let's Get Ready to Rumble!!!!!! I like Jim Cramer. I find his show entertaining, a guilty pleasure. I have bought some stocks based upon his recommendations and have actually done quite well. He has had some big misses lately, as I recall UNH was his best stock pick for 2006. MO was his best Dow pick for 2006. I suspect he has already changed his mind.I will give Jimbo credit. On his Mad Money Website Mad Money TV Show

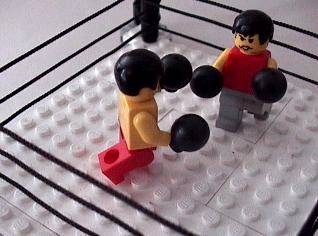

Performance by Show Date, he actually lists the performance of his recommendations by show. That does take courage. So I thought it would be fun to see how he has fared versus my first three sample MFI Portfolios. Now understand their approaches are as similar as Chalk and Cheese. Cramer is a trader, Greenblatt is an investor. They are both smart in their own way. And they are both trying to help the "little guy", meaning us. I will also add the Russell 3000 ETF, guess we'll call the Seigel for his book a "Random Walk Down Wall Street" where he says to just buy the market as that way you won't be disappointed.

I do laugh about Mad Money though. Do you think Cramer has more Stock Analysts or Lawyers working on his production team? Okay, enough chit chat. Let us see who has done better. Drum Roll Please...

| February 17th | April 7th | May 12th | |

| Cramer | -2.71% | -5.85% | -8.64% |

| Greenblatt | -2.06% | -9.58% | -3.98% |

| Seigel | -1.47% | -2.68% | -2.18% |

Stock Insights:

TGIS - this is my mysterious stock that dropped from the MFI list despite a stellar 1st quarter. It also mysteriously got hammered yesterday. I saw in Yahoo Groups that they posted their quarterly numbers in Compustat last night and that matched their re-appearance.

CHKE - had their quarterly earnings today. I was pleased, 7% growth assuming that a 900K royalty payment is forthcoming.

Didn't gain anything on Russell 3000 today, we were both down another .67%. We definitely need some clear indication from the Fed for the hemoraging to cease.

Happy investing!

No comments:

Post a Comment