Thursday, November 30, 2006

V(phm)ROOM!!!!

Solid day for my MFI portfolio, up 0.7%. Driven by VPHM (up 5.6%) and ORCT (up 12.6%). ORCT is now just down just 3.4%... up about 47% in the past 6 weeks! VPHM has gone from $13.10 after turkey day to $15.41.

I was wondering what has caused VPHM to shoot up. They had 2 investor conferences this week (ViroPharma to Present at Two Additional Healthcare Conferences). I figure they must have said something good. Maybe if I get some time I'll watch their webcast.

OVTI reported earnings tonight (OmniVision Reports Financial Results for Second Quarter of Fiscal 2007). They were not what people had hoped for (despite lowered expectations) and they dropped about 8% AH.

I was wondering what has caused VPHM to shoot up. They had 2 investor conferences this week (ViroPharma to Present at Two Additional Healthcare Conferences). I figure they must have said something good. Maybe if I get some time I'll watch their webcast.

OVTI reported earnings tonight (OmniVision Reports Financial Results for Second Quarter of Fiscal 2007). They were not what people had hoped for (despite lowered expectations) and they dropped about 8% AH.

Wednesday, November 29, 2006

The Water is Fine!

Great day in the market. My MFI portfolio was up 1.4% vs the benchmark being up 1.1%. VPHM was my big winner, up 7.5%. PTEN also moved back to the black for me, up 6.7%. It was a good day for anything related to oil.

I did buy HW based upon their refining comments yesterday. So it is my latest sidecar holding (along with EZEN, TRLG & ASPV). They went up nicely for me, but I think it was more a market move than HW-specific.

A few weeks ago mentioned that JG recommended Claire Stores, Autozone and Aerostaple. It actually was announced that he had been buying ARO for his hedge fund. Then early this week, a firm downgraded ARO prompting this article on Monday (Aeropostale: Buy or Sell?). Well ARO announced their earnings yesterday... wow! (Aeropostale shares surge 6% on quarterly results).

EZEN had an interesting announcment after the market closed (Ezenia Receives $1 Million Award for SBIR Phase II Contract Extension). Doesn't seem like much money, and reading the fine print, they are the lead contractor but will have to then turn around and pay some subcontractors out of the $. Hard to get too excited, but it does show that outside parties do want to do business with Ezenia!. (I just like typing that exclamation mark!). If EZEN pops tomorrow on the news, it may be a good opportunity to sell my sidecar holdings. Here is where the portfolio stands:

I did buy HW based upon their refining comments yesterday. So it is my latest sidecar holding (along with EZEN, TRLG & ASPV). They went up nicely for me, but I think it was more a market move than HW-specific.

A few weeks ago mentioned that JG recommended Claire Stores, Autozone and Aerostaple. It actually was announced that he had been buying ARO for his hedge fund. Then early this week, a firm downgraded ARO prompting this article on Monday (Aeropostale: Buy or Sell?). Well ARO announced their earnings yesterday... wow! (Aeropostale shares surge 6% on quarterly results).

EZEN had an interesting announcment after the market closed (Ezenia Receives $1 Million Award for SBIR Phase II Contract Extension). Doesn't seem like much money, and reading the fine print, they are the lead contractor but will have to then turn around and pay some subcontractors out of the $. Hard to get too excited, but it does show that outside parties do want to do business with Ezenia!. (I just like typing that exclamation mark!). If EZEN pops tomorrow on the news, it may be a good opportunity to sell my sidecar holdings. Here is where the portfolio stands:

| Current Portfolio | |||

| Stock | Cost | Current | Gain |

| UST | $39.36 | $56.25 | 47.2% |

| PNCL | $6.68 | $9.60 | 43.7% |

| ASEI | $45.85 | $63.30 | 38.1% |

| TGIS | $10.34 | $13.25 | 30.0% |

| MSTR | $94.36 | $119.68 | 26.8% |

| BBSI | $19.56 | $24.44 | 25.3% |

| VPHM | $11.80 | $14.60 | 23.7% |

| CHKE | $37.55 | $42.30 | 17.8% |

| ELX | $17.85 | $20.98 | 17.5% |

| MTEX | $13.11 | $15.16 | 16.9% |

| ANF | $61.13 | $69.59 | 14.7% |

| MGLN | $38.34 | $42.85 | 11.8% |

| FTO | $28.76 | $31.79 | 10.9% |

| PGI | $7.71 | $8.09 | 4.9% |

| BLDR | $15.91 | $16.52 | 3.9% |

| PTEN | $26.72 | $27.31 | 2.6% |

| ISNS | $13.17 | $13.00 | -1.3% |

| DLX | $26.36 | $24.51 | -3.6% |

| RAIL | $58.18 | $55.26 | -4.9% |

| KG | $17.31 | $16.40 | -5.3% |

| PACR | $32.53 | $29.56 | -7.7% |

| TBL | $34.50 | $31.33 | -9.2% |

| PONR | $30.98 | $27.99 | -9.7% |

| TRLG | $17.02 | $15.00 | -11.9% |

| ORCT | $11.83 | $10.14 | -14.3% |

| HW | $33.04 | $23.59 | -28.6% |

| FDG | $34.03 | $20.73 | -34.4% |

| EZEN | $2.84 | $1.85 | -34.7% |

| OVTI | $27.79 | $16.61 | -40.2% |

| Current Gain/Loss ($) | $13,116 | ||

| Current Gain/Loss (%) | 4.0% | ||

| Sold Gain/Loss ($) | $10,050 | ||

| Sold Gain/Loss (%) | 25.0% | ||

| Total Gain/Loss ($) | $23,166 | ||

| Benchmark Gain/Loss ($) | $30,354 | ||

| Annual IRR | 12.9% | ||

| Total Gain/Loss (%) | 7.3% | ||

Tuesday, November 28, 2006

A Head ahead

Just another day in the marathon that is MFI investing. Portfolio was up a scant 0.15%. ELX, ASEI & VPHM were my best stocks. ELX has quietly gone up 15% since I bought them. OVTI was my big loser, down about 3.5%. They report earnings on Thursday and I guess analysts are getting skittish (OmniVision Slips on Pricing Concerns).

I think the most interesting thing in my portfolio today was an announcement by HW that pretty much went unnoticed, a collective "ho-hum" by Mr Market. They announced a new and better way to refine heavy crude oil (Headwaters Rolls Out New Refining Idea). As one might expect, there is a lot more heavy crude oil around than the good stuff (light sweet crude oil. To me this seems to be a big deal for a company under $1b in market cap.

Now perhaps this is really "old" news and the market has already priced this new technology in... but to be honest I don't see how as the stock isn't exactly selling at a premium. Anyway, I am going to do a little digging tonight and will likely more than double my HW holdings tomorrow. Not sure if HW is still tecnically on the MFI lists, so that will determine whether it is a side car holding. For the record HW closed at $23.23 today, up 19 cents.

I think the most interesting thing in my portfolio today was an announcement by HW that pretty much went unnoticed, a collective "ho-hum" by Mr Market. They announced a new and better way to refine heavy crude oil (Headwaters Rolls Out New Refining Idea). As one might expect, there is a lot more heavy crude oil around than the good stuff (light sweet crude oil. To me this seems to be a big deal for a company under $1b in market cap.

Now perhaps this is really "old" news and the market has already priced this new technology in... but to be honest I don't see how as the stock isn't exactly selling at a premium. Anyway, I am going to do a little digging tonight and will likely more than double my HW holdings tomorrow. Not sure if HW is still tecnically on the MFI lists, so that will determine whether it is a side car holding. For the record HW closed at $23.23 today, up 19 cents.

Monday, November 27, 2006

Quick Hits

Not sure if the title is because this post will be quick or because my MFI portfolio took a quick hit today. Down a whopping 2%, led by TGIS (6.7% drop). I was glad I sold CLE last week in my side car holdings as it was down $1.94 or 6%.

Interesting article about ANF as they are hinting that they may start a new line of stores (Abercrombie & Fitch's Little Secret).

FTO, EZEN, VPHM and ORCT were my only stocks that managed to go up.

Still noodling over what to do in December. Should I sell a loser (ie FDG) for tax purposes? Should I add any $ to my MFI portfolio? We'll see.

Interesting article about ANF as they are hinting that they may start a new line of stores (Abercrombie & Fitch's Little Secret).

FTO, EZEN, VPHM and ORCT were my only stocks that managed to go up.

Still noodling over what to do in December. Should I sell a loser (ie FDG) for tax purposes? Should I add any $ to my MFI portfolio? We'll see.

Sunday, November 26, 2006

Paying Dividends

I will be collecting dividends from BBSI & CHKE next week. Not sure what the overall yield is on my portfolio, I'd guess around 1.5%. Not that paying dividends makes a stock a "good" stock, but to see a stock begin paying dividends (such as BBSI recently announced (BBSI Declares First Quarterly Cash Dividend)) or to see a stock increase their dividends (Cherokee Announces December Quarterly Dividend Increased to $0.75 Per Share) is a sign that the company is feeling upbeat about the future (as it is painful to reduce or stop dividends).

Let us see, here are the divdends for my MFI stocks:

ANF 1.0%

ASEI none

BBSI 1.1%

CHKE 6.9%

DLX 4.1%

ELX none

EZEN none

FDG 13.9%

FTO 0.4%

HW none

ISNS none

KG none

MGLN none

MSTR none

MTEX 2.1%

ORCT none

OVTI none

PACR 2.0%

PGI none

PNCL none

PONR none

PTEN 1.2%

RAIL 0.4%

TBL none

TGIS 2.2%

TRLG none

UST 4.0%

VPHM none

Hmm, looks like my 1.5% was pretty close. It was better when I had PCU (10.4%).

Here is a list of my stocks and their performance

Let us see, here are the divdends for my MFI stocks:

ANF 1.0%

ASEI none

BBSI 1.1%

CHKE 6.9%

DLX 4.1%

ELX none

EZEN none

FDG 13.9%

FTO 0.4%

HW none

ISNS none

KG none

MGLN none

MSTR none

MTEX 2.1%

ORCT none

OVTI none

PACR 2.0%

PGI none

PNCL none

PONR none

PTEN 1.2%

RAIL 0.4%

TBL none

TGIS 2.2%

TRLG none

UST 4.0%

VPHM none

Hmm, looks like my 1.5% was pretty close. It was better when I had PCU (10.4%).

Here is a list of my stocks and their performance

| Current Portfolio | |||

| Stock | Cost | Current | Gain |

| PNCL | $6.68 | $10.06 | 50.6% |

| UST | $39.36 | $56.42 | 47.7% |

| ASEI | $45.85 | $63.29 | 38.0% |

| TGIS | $10.34 | $13.75 | 34.9% |

| MSTR | $94.36 | $125.96 | 33.5% |

| BBSI | $19.56 | $24.40 | 25.1% |

| CHKE | $37.55 | $43.45 | 20.9% |

| MTEX | $13.11 | $15.15 | 16.8% |

| ELX | $17.85 | $20.76 | 16.3% |

| ANF | $61.13 | $70.51 | 16.2% |

| MGLN | $38.34 | $43.29 | 12.9% |

| VPHM | $11.80 | $13.10 | 11.0% |

| BLDR | $15.91 | $16.99 | 6.8% |

| PGI | $7.71 | $8.20 | 6.3% |

| FTO | $28.76 | $29.72 | 3.7% |

| ISNS | $13.17 | $13.01 | -1.2% |

| PTEN | $26.72 | $26.05 | -2.1% |

| RAIL | $58.18 | $56.25 | -3.2% |

| DLX | $26.36 | $24.56 | -3.4% |

| KG | $17.31 | $16.55 | -4.4% |

| TBL | $34.50 | $32.12 | -6.9% |

| PACR | $32.53 | $29.81 | -7.0% |

| PONR | $30.98 | $28.24 | -8.8% |

| TRLG | $17.02 | $15.38 | -9.6% |

| ORCT | $11.83 | $10.43 | -11.8% |

| HW | $33.04 | $23.45 | -29.0% |

| OVTI | $27.79 | $18.42 | -33.7% |

| FDG | $34.03 | $20.80 | -34.2% |

| EZEN | $2.84 | $1.82 | -35.8% |

| Current Gain/Loss ($) | $15,124 | ||

| Current Gain/Loss (%) | 4.6% | ||

| Sold Gain/Loss ($) | $10,050 | ||

| Sold Gain/Loss (%) | 25.0% | ||

| Total Gain/Loss ($) | $25,173 | ||

| Benchmark Gain/Loss ($) | $31,293 | ||

| Annual IRR | 14.0% | ||

| Total Gain/Loss (%) | 8.0% | ||

Saturday, November 25, 2006

No News is Good News?

Light news week as everyone was focused on family & turkey. I know I ate my fair share and then some! According to this article, shoppers were out in force on Friday (Black Friday Is Golden for Retailers) . I generally give these types of articles as much credence as analyst upgrades & downgrades. Not very much. I think it was last year some article said the 3 days after Thanksgiving had sales up about 20%. I think they must've made a slight calculation error.

Light news week as everyone was focused on family & turkey. I know I ate my fair share and then some! According to this article, shoppers were out in force on Friday (Black Friday Is Golden for Retailers) . I generally give these types of articles as much credence as analyst upgrades & downgrades. Not very much. I think it was last year some article said the 3 days after Thanksgiving had sales up about 20%. I think they must've made a slight calculation error.Hey pretty good memory. Using "the google" I found an article about last year's first weekend:

U.S. Retailers Post $27.8 Billion in Weekend Sales (Update1)

By Cotten Timberlake and Shobhana Chandra

Nov. 28 (Bloomberg) -- U.S. retailers recorded sales of $27.8 billion over the holiday weekend, putting the industry on track for its second-biggest selling season since 1999, said the National Retail Federation.

Total sales including online rose 22 percent from a year earlier, spurred by discounts and demand for electronics, the NRF said in a statement yesterday. Discounters including Wal-Mart Stores Inc., which offered $398 laptop computers, attracted the most shoppers, according to survey of more than 4,000 consumers by the Washington-based trade group.

Enough on that. PNCL has firmly moved into my #1 slot, now up 50%. This shows that when you go into MFI, you need to check your biases at the door. Many people said they would not buy airline stocks as they are "poor businesses". Oh well, I know I have had my own biases, I will try and be open-minded. Have a good one!

Wednesday, November 22, 2006

Happy Thanksgving!

Happy Thanksgiving everyone! Hope the Cowboys can win.

Happy Thanksgiving everyone! Hope the Cowboys can win.Another solid day. I did sell CLE from my sidecar for a 15% profit. ASPV went up 8% as well, it was a very good day in the side car, which is actually approaching the gains of my MFI portfolio despite just 4 or 5 stocks at a time.

I read a good article in the WSJ today. It was discussing that Generic Drug companies may benefit under the Democrats. The argument was that the Dems can lower the cost of healthcare without price controls by closing some patent loopholes. Obviously, if that is good for generic drug companies it may be bad for non-generics. That does have MFI implications if you want to think along those lines. BVF, AXCA and ASPV are all non-generic drug companies threatened by generics. BRL is an interesting generic play showing up in many lists. I just bought some BRL for my kid's college funds and bought TEVA for mynon-MFI account.

Not much to discuss regarding my MFI portfolio. It is pretty much cruise control right now. In the next 3 weeks or so, I will have to decide whether the sell a loser (like FDG) before year end for tax purposes.

Monday, November 20, 2006

Magical Wedding

No, not that "magical wedding"!

No, not that "magical wedding"!Today FCX announced they were buying PD for about a 30% premium (Freeport makes $26 billion copper play with Phelps Dodge deal). Sadly, I did not own PD (had them about a year ago and did nicely). It does raise an interesting question for MFI investors. If you own PD as an MFI stock, should you take the shares of FCX or cash in all your chips? I guess my tendancy would be to hold the FCX in order to minimize taxes. FCX should stll be a MFI stock after all is said and done.

My MFI portfolio (not aided by M&A) was up slightly today. I did (just for kicks) look at my IRR thus far and then what it qould be with mt side car picks tossed in. It was surprising. My IRR right now is a respectable 14%... but with the side car investments included, it spikes to 22%! Wow.

I do not count the side car investments as I do not intend to hold them for a year. They have been opportunistic purchases of MFI stocks in my IRA. I have picked well, with 2 stocks (in a short time frame) NSS & PLAY being bought and ASEI went up about 20% in a week. Right now I have EZEN, TRLG, ASPV & CLE in the side car.

Friday, November 17, 2006

Getting Frothy?

Wow, the market seems to just keep going up. Don't know about you, but that makes me a wee bit nervous. My MFI portfolio had another steller week.

I wonder what impact the USAir bid for Delta will have on companies like PNCL? If you are a feeder airline supporting a legacy carrier and that carrier gets bought... where does that leave you? I suppose that the capacity is still needed.

Power of predicting - Readers may recall that 6 weeks ago I rated all my stocks a "1", "2" or "3" with a "1" being the stocks that I would buy more of, a "3" are stocks I would sell into a rally. 6 weeks is not enough to really say how well I did but here is how they have done:

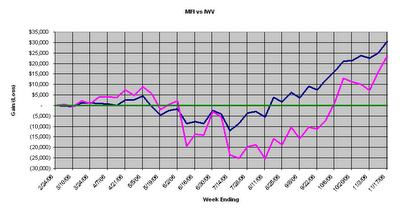

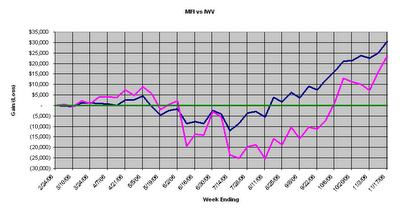

Now for the weekly charts:

I wonder what impact the USAir bid for Delta will have on companies like PNCL? If you are a feeder airline supporting a legacy carrier and that carrier gets bought... where does that leave you? I suppose that the capacity is still needed.

Power of predicting - Readers may recall that 6 weeks ago I rated all my stocks a "1", "2" or "3" with a "1" being the stocks that I would buy more of, a "3" are stocks I would sell into a rally. 6 weeks is not enough to really say how well I did but here is how they have done:

- 1: +9.8%

- 2: +10.2%

- 3: -0.5%

Now for the weekly charts:

| Current Portfolio | |||

| Stock | Cost | Current | Gain |

| PNCL | $6.68 | $9.82 | 47.0% |

| UST | $39.36 | $55.61 | 45.6% |

| ASEI | $45.85 | $65.36 | 42.6% |

| TGIS | $10.34 | $13.61 | 33.5% |

| MSTR | $94.36 | $124.89 | 32.4% |

| BBSI | $19.56 | $23.81 | 21.7% |

| CHKE | $37.55 | $43.39 | 18.7% |

| ANF | $61.13 | $71.09 | 16.9% |

| ELX | $17.85 | $20.85 | 16.8% |

| MGLN | $38.34 | $44.39 | 15.8% |

| MTEX | $13.11 | $14.99 | 15.6% |

| VPHM | $11.80 | $13.51 | 14.5% |

| PGI | $7.71 | $8.60 | 11.5% |

| BLDR | $15.91 | $16.70 | 5.0% |

| FTO | $28.76 | $29.56 | 3.0% |

| ISNS | $13.17 | $13.00 | -1.3% |

| DLX | $26.36 | $24.87 | -2.2% |

| RAIL | $58.18 | $55.72 | -4.2% |

| KG | $17.31 | $16.40 | -5.3% |

| PTEN | $26.72 | $25.12 | -5.5% |

| TBL | $34.50 | $31.93 | -7.4% |

| PACR | $32.53 | $29.30 | -9.0% |

| TRLG | $17.02 | $15.40 | -9.5% |

| PONR | $30.98 | $27.91 | -9.9% |

| ORCT | $11.83 | $10.56 | -10.7% |

| HW | $33.04 | $23.21 | -29.8% |

| FDG | $34.03 | $20.87 | -34.0% |

| OVTI | $27.79 | $17.63 | -36.6% |

| EZEN | $2.84 | $1.73 | -39.0% |

| Current Gain/Loss ($) | $13,531 | ||

| Current Gain/Loss (%) | 4.1% | ||

| Sold Gain/Loss ($) | $10,050 | ||

| Sold Gain/Loss (%) | 25.0% | ||

| Total Gain/Loss ($) | $23,581 | ||

| Benchmark Gain/Loss ($) | $30,312 | ||

| Annual IRR | 13.9% | ||

| Total Gain/Loss (%) | 7.5% | ||

Wednesday, November 15, 2006

Regression to the Mean

ORCT and TBL have been out-performing of late for me. Today it was regression to the mean for these two stocks. ORCT was down 4.7% and TBL was down 3.9%. Toss in ANF which was punished today for last night's earnings (dropped 6%) and you think I'd be in trouble, right? But the portfolio has 29 stocks, and can afford a couple downers.

Overall up 0.38% with BLDR and FDG leading the way. The Fed made some positive comments about housing which spiked BLDR up 4% (Fed minutes show concern on inflation).

Recent data from the housing sector gave comfort to "many" FOMC members. The data "suggested that the correction in the housing market was likely to be no more severe than they had previously expected and that the risk of an even larger contraction in this sector had ebbed."

Here is how my stocks have fared, updated as I am home again. I am now up 7.8%. Still down about $5k to benchmark.

Overall up 0.38% with BLDR and FDG leading the way. The Fed made some positive comments about housing which spiked BLDR up 4% (Fed minutes show concern on inflation).

Recent data from the housing sector gave comfort to "many" FOMC members. The data "suggested that the correction in the housing market was likely to be no more severe than they had previously expected and that the risk of an even larger contraction in this sector had ebbed."

Here is how my stocks have fared, updated as I am home again. I am now up 7.8%. Still down about $5k to benchmark.

| Current Portfolio | |||

| Stock | Cost | Current | Gain |

| PNCL | $6.68 | $9.71 | 45.4% |

| UST | $39.36 | $54.83 | 43.6% |

| ASEI | $45.85 | $65.30 | 42.4% |

| MSTR | $94.36 | $127.66 | 35.3% |

| TGIS | $10.34 | $13.53 | 32.7% |

| BBSI | $19.56 | $23.75 | 21.4% |

| MTEX | $13.11 | $15.45 | 19.1% |

| CHKE | $37.55 | $43.31 | 18.5% |

| ANF | $61.13 | $72.01 | 18.4% |

| MGLN | $38.34 | $45.08 | 17.6% |

| ELX | $17.85 | $20.97 | 17.5% |

| VPHM | $11.80 | $13.18 | 11.7% |

| PGI | $7.71 | $8.52 | 10.5% |

| BLDR | $15.91 | $17.00 | 6.9% |

| FTO | $28.76 | $30.48 | 6.2% |

| ISNS | $13.17 | $13.00 | -1.3% |

| DLX | $26.36 | $25.00 | -2.7% |

| RAIL | $58.18 | $55.92 | -3.8% |

| PTEN | $26.72 | $25.52 | -4.0% |

| ORCT | $11.83 | $11.05 | -6.6% |

| TBL | $34.50 | $32.06 | -7.1% |

| KG | $17.31 | $15.99 | -7.6% |

| PACR | $32.53 | $29.48 | -8.5% |

| TRLG | $17.02 | $15.33 | -9.9% |

| PONR | $30.98 | $27.85 | -10.1% |

| HW | $33.04 | $23.82 | -27.9% |

| OVTI | $27.79 | $18.23 | -34.4% |

| FDG | $34.03 | $20.45 | -35.2% |

| EZEN | $2.84 | $1.65 | -41.8% |

| Current Gain/Loss ($) | $14,652 | ||

| Current Gain/Loss (%) | 4.5% | ||

| Sold Gain/Loss ($) | $10,050 | ||

| Sold Gain/Loss (%) | 25.0% | ||

| Total Gain/Loss ($) | $24,702 | ||

| Benchmark Gain/Loss ($) | $29,800 | ||

| Annual IRR | 14.8% | ||

| Total Gain/Loss (%) | 7.8% | ||

Tuesday, November 14, 2006

Timber..... (Land)

One thing about MFI is that it insists that you hold the stocks for a year. I don't know whether that is the "right" amount of time, but it does keep me from panicking. TBL is a great example (as is DLX). TBL got as low as $24.80 back in July. Today they announced that they will explore a sale of the company (Timberland considering plan to sell itself: report). The stock is up 5% early today at $32.72. That is a big recovery from $25.

One thing about MFI is that it insists that you hold the stocks for a year. I don't know whether that is the "right" amount of time, but it does keep me from panicking. TBL is a great example (as is DLX). TBL got as low as $24.80 back in July. Today they announced that they will explore a sale of the company (Timberland considering plan to sell itself: report). The stock is up 5% early today at $32.72. That is a big recovery from $25."There You Go Again!" - Seasoned readers will remember that quote from Ronald Reagan. ORCT is at it again, up another 38 cents this a.m. on stronger than average volume. Not sure what is driving it, either rumors or some accumulation by institutions.

ANF reports their earnings this evening after the market closes. Yes, I am nervous.

It is the end f the day. It was a monster day fo my MFI portfolio, up 1.77% compared to the IWV +0.77%. While traveling, I can't run my normal charts as I don't like to log onto my brokerage account anywhere but home... but I think I am only about 5K behind the benchmark now.

Stock News

OVTI has takeover rumors (OmniVision up on takeover speculation).

ORCT ended up 11.7%. I am now down just 2% on a stock that used to be down over 40%.

ANF had their earnings (Abercrombie & Fitch posts higher quarterly profit, sales). The stock is down about 4.5% after hours. I will dissect the numbers later but on the surface they look good.

- $1.11 eps vs $0.79 last year.

- Same store sales up 5%.

- For the year they forecast $4.59 to $4.65 eps.

My purchase of CLE last week in my sidecar is looking savvy so far as it is up 6% already. The TRLG sidecar purchase looks less savvy as it has down about 5%.

Monday, November 13, 2006

Watching the Wheels

Im just sitting here watching the wheels go round and round

I really love to watch them roll

No longer riding on the merry-go-round

I just had to let it go

Early Monday a.m. in SF. The market is open at 6:30 here. Must be strange.

ORCT Action - not sure what is going on with ORCT. I went back and looked and it has really been moving.

Copper stocks are dropping, I am losing my seller's remorse for selling PCU. And PTSC has dropped to 66 cents from my sale of 92 cents. Whew!

The day is done... another solid day as my MFI once again trumps the benchmark. Overall up 0.46%. ORCT was the big gainer. FDG was my worst stock, I think it may now be my worst overall. FDG, EZEN & OVTI are all down about 40%. I may sell FDG before year-end for taxe purposes, we'll see.

Here is the most recent lost of 50 stocks over 100m. I like to post them every now and then as I view my blog as a time capsule to some extent. LOL.

I really love to watch them roll

No longer riding on the merry-go-round

I just had to let it go

Early Monday a.m. in SF. The market is open at 6:30 here. Must be strange.

ORCT Action - not sure what is going on with ORCT. I went back and looked and it has really been moving.

- Oct 24th closed at $7.39

- Oct 25th, closed up to $8.54 trading 1.7m shares (136k average)

- Nov 9th closed at $8.84

- Nov 10th closed at $9.58 on 266k volume

- Today up to $10.36 on heavy early volume (175K).

Copper stocks are dropping, I am losing my seller's remorse for selling PCU. And PTSC has dropped to 66 cents from my sale of 92 cents. Whew!

The day is done... another solid day as my MFI once again trumps the benchmark. Overall up 0.46%. ORCT was the big gainer. FDG was my worst stock, I think it may now be my worst overall. FDG, EZEN & OVTI are all down about 40%. I may sell FDG before year-end for taxe purposes, we'll see.

Here is the most recent lost of 50 stocks over 100m. I like to post them every now and then as I view my blog as a time capsule to some extent. LOL.

| Name (in alphabetical order) | Ticker | Market Cap ($ Millions) | Pre Tax Earnings Yield | Pre Tax Return on Capital | Price From | Most Recent Quarter Data |

|---|---|---|---|---|---|---|

| Accenture Ltd | ACN | 19,664.08 | 9% | > 100% | 11/12 | 08/31 |

| Aspreva Pharmaceuticals Corp | ASPV | 617.08 | 32% | > 100% | 11/12 | 09/30 |

| Bally Total Fitness Holding Corp. | BFT | 108.66 | 9% | > 100% | 11/12 | 06/30 |

| Barrett Business Services Inc | BBSI | 261.11 | 11% | > 100% | 11/12 | 09/30 |

| Bradley Pharmaceuticals Inc. | BDY | 302.22 | 9% | > 100% | 11/12 | 06/30 |

| CGI Group Inc. | GIB | 2,282.32 | 10% | > 100% | 11/12 | 06/30 |

| Career Education Corp | CECO | 2,222.54 | 14% | 50 - 75% | 11/12 | 09/30 |

| Cavco Industries Inc | CVCO | 214.81 | 14% | > 100% | 11/12 | 09/30 |

| Conn's Inc | CONN | 556.17 | 17% | 50 - 75% | 11/12 | 07/31 |

| Cryptologic Inc | CRYP | 258.97 | 18% | > 100% | 11/12 | 09/30 |

| Deb Shops Inc | DEBS | 389.01 | 13% | > 100% | 11/12 | 07/31 |

| Deluxe Corp | DLX | 1,228.30 | 10% | > 100% | 11/12 | 09/30 |

| Eagle Test Systems Inc | EGLT | 309.83 | 17% | > 100% | 11/12 | 06/30 |

| ExpressJet Holdings Inc. | XJT | 397.26 | 41% | 50 - 75% | 11/12 | 06/30 |

| Fording Canadian Coal Trust | FDG | 2,910.60 | 23% | > 100% | 11/12 | 09/30 |

| Freeport-McMoran Copper & Gold Inc. | FCX | 11,008.75 | 23% | 75 - 100% | 11/12 | 09/30 |

| Frontier Oil Corp. | FTO | 3,257.49 | 19% | > 100% | 11/12 | 09/30 |

| Harvest Natural Resources Inc. | HNR | 379.01 | 17% | > 100% | 11/12 | 09/30 |

| Intersections Inc | INTX | 173.66 | 12% | 75 - 100% | 11/12 | 09/30 |

| King Pharmaceuticals Inc. | KG | 3,933.58 | 18% | > 100% | 11/12 | 09/30 |

| Korn/Ferry International | KFY | 931.88 | 10% | > 100% | 11/12 | 07/31 |

| Labor Ready Inc. | LRW | 952.62 | 13% | 75 - 100% | 11/12 | 09/30 |

| Lam Research Corp | LRCX | 6,455.89 | 10% | > 100% | 11/12 | 09/30 |

| Lamson & Sessions Co | LMS | 330.51 | 23% | 50 - 75% | 11/12 | 09/30 |

| Mannatech Inc | MTEX | 384.52 | 14% | > 100% | 11/12 | 06/30 |

| Merge Technologies Inc | MRGE | 182.56 | 14% | > 100% | 11/12 | 06/30 |

| Motorola Inc. | MOT | 51,686.15 | 11% | > 100% | 11/12 | 09/30 |

| New Frontier Media Inc | NOOF | 213.34 | 11% | > 100% | 11/12 | 09/30 |

| Nucor Corp | NUE | 18,101.41 | 15% | 50 - 75% | 11/12 | 09/30 |

| Odyssey Healthcare Inc | ODSY | 425.23 | 11% | > 100% | 11/12 | 09/30 |

| OmniVision Technologies Inc | OVTI | 894.31 | 20% | > 100% | 11/12 | 07/31 |

| Optimal Group Inc | OPMR | 220.99 | 10% | > 100% | 11/12 | 09/30 |

| PW Eagle Inc | PWEI | 442.31 | 37% | > 100% | 11/12 | 09/30 |

| Pacer International Inc | PACR | 1,078.01 | 10% | > 100% | 11/12 | 09/30 |

| Palm Inc | PALM | 1,513.38 | 13% | > 100% | 11/12 | 08/31 |

| Pinnacle Airlines Corp | PNCL | 213.96 | 33% | > 100% | 11/12 | 06/30 |

| PortalPlayer Inc | PLAY | 337.93 | 19% | > 100% | 11/12 | 09/30 |

| Prestige Brands Holdings Inc | PBH | 559.09 | 10% | > 100% | 11/12 | 09/30 |

| Sonic Solutions | SNIC | 382.86 | 9% | > 100% | 11/12 | 09/30 |

| Southern Copper Corp | PCU | 16,030.40 | 16% | 50 - 75% | 11/12 | 09/30 |

| Teck Cominco Ltd | TCK | 16,244.39 | 19% | 50 - 75% | 11/12 | 09/30 |

| Thor Industries Inc. | THO | 2,442.40 | 12% | 75 - 100% | 11/12 | 07/31 |

| United Industrial Corp | UIC | 472.83 | 13% | > 100% | 11/12 | 09/30 |

| Vaalco Energy Inc | EGY | 480.29 | 18% | > 100% | 11/12 | 06/30 |

| Valassis Communications Inc. | VCI | 717.91 | 16% | > 100% | 11/12 | 09/30 |

| Vertrue Inc | VTRU | 392.93 | 10% | > 100% | 11/12 | 09/30 |

| Western Refining Inc | WNR | 1,664.13 | 19% | > 100% | 11/12 | 06/30 |

| Westwood One Inc. | WON | 570.43 | 11% | > 100% | 11/12 | 06/30 |

| Williams Controls Inc | WMCO | 100.79 | 13% | 75 - 100% | 11/12 | 06/30 |

| World Air Holdings Inc | WLDA | 211.52 | 16% | 75 - 100% | 11/12 | 06/30 |

Friday, November 10, 2006

I Can See "Clairely" Now

I can see clearly now, the rain is gone,

I can see clearly now, the rain is gone, I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright), bright (bright) Sun-Shiny day.

I think I can make it now, the pain is gone

All of the bad feelings have disappeared

Here is the rainbow I’ve been prayin?for

It’s gonna be a bright (bright), bright (bright) Sun-Shiny day.

Look all around, there’s nothin?but blue skies

Look straight ahead, nothin?but blue skies

I can see clearly now, the rain is gone,

I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright), bright (bright) Sun-Shiny day.

Been a while since I quoted some lyrics in my blog. But why not? I'm in a great mood. My MFI portfolio shot up 1.6% today... don't ask me why as the market wasn't up like that. Then I am off to San Francisco tomorrow. Always great to see the city by the bay ("Sitting on the dock of the Bay...").

Saw a very interesting note from Mr Greenblatt today (Greenblatt eyes Claire's, Autozone, Aeropostale). Readers may recall that I uncovered a recording from last December where JG recommended Autozone, Lexmark & The Gap from his MFI list. If you had bought those three back then you'd be up 28%. Like the old EF Hutton commercials, when Joel Greenblatt talks... we should listen. And so I did, I bought CLE at $27.50 today. It will not be part of my MFI portfolio as (1) I don't want to add more stocks and (2) I wanted to buy more than "normal". It is in my "Sidecar" portfolio. I sold my ASEI in the sidecar today after a 20% gain in the past week.

A bunch of my laggards were great today:

- ORCT + 8.4%

- EZEN +5.4%

- TBL +6.2%

- HW +3.1%

| Current Portfolio | |||

| Stock | Cost | Current | Gain |

| PNCL | $6.68 | $9.69 | 45.1% |

| UST | $39.36 | $54.51 | 42.8% |

| ASEI | $45.85 | $63.31 | 38.1% |

| TGIS | $10.34 | $13.64 | 33.8% |

| MSTR | $94.36 | $125.02 | 32.5% |

| ANF | $61.13 | $74.38 | 22.2% |

| BBSI | $19.56 | $23.22 | 18.7% |

| CHKE | $37.55 | $43.00 | 17.7% |

| ELX | $17.85 | $19.99 | 12.0% |

| MGLN | $38.34 | $42.86 | 11.8% |

| MTEX | $13.11 | $14.46 | 11.5% |

| PGI | $7.71 | $8.28 | 7.4% |

| VPHM | $11.80 | $12.30 | 4.2% |

| FTO | $28.76 | $29.43 | 2.5% |

| BLDR | $15.91 | $16.26 | 2.2% |

| ISNS | $13.17 | $13.11 | -0.5% |

| RAIL | $58.18 | $55.16 | -5.1% |

| PTEN | $26.72 | $25.22 | -5.2% |

| KG | $17.31 | $16.18 | -6.5% |

| DLX | $26.36 | $23.89 | -6.9% |

| TBL | $34.50 | $31.74 | -8.0% |

| TRLG | $17.02 | $15.47 | -9.1% |

| PACR | $32.53 | $29.25 | -9.2% |

| PONR | $30.98 | $26.91 | -13.1% |

| ORCT | $11.83 | $9.58 | -19.0% |

| HW | $33.04 | $22.66 | -31.4% |

| FDG | $34.03 | $19.80 | -37.1% |

| EZEN | $2.84 | $1.74 | -38.6% |

| OVTI | $27.79 | $16.41 | -40.9% |

| Current Gain/Loss ($) | $5,897 | ||

| Current Gain/Loss (%) | 1.8% | ||

| Sold Gain/Loss ($) | $10,050 | ||

| Sold Gain/Loss (%) | 25.0% | ||

| Total Gain/Loss ($) | $15,947 | ||

| Benchmark Gain/Loss ($) | $24,764 | ||

| Annual IRR | 10.1% | ||

| Total Gain/Loss (%) | 5.0% | ||

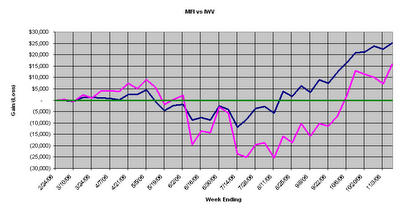

A recap for newer readers. I have sold 5 MFI stocks: IVII, NCOG, NSS, PTSC & PCU. The 1st three were bought by other companies. I decided PTSC really wasn't an MFI stock (and frankly I could not stand the volaility). Then PCU had been called an MFI stock by me at the start but was in my normal portfolio already. I only counted the gains from when I started MFI. Here is my weekly graph. Remember for new readers that the blue line represents the change in the benchmark investment since Feb 24th. The Magenta line is my MFI portfolio of 29 stocks. The green line represents breakeven. I think you'll agree that the trend is my friend:

Subscribe to:

Posts (Atom)