I can see clearly now, the rain is gone,

I can see clearly now, the rain is gone, I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright), bright (bright) Sun-Shiny day.

I think I can make it now, the pain is gone

All of the bad feelings have disappeared

Here is the rainbow I’ve been prayin?for

It’s gonna be a bright (bright), bright (bright) Sun-Shiny day.

Look all around, there’s nothin?but blue skies

Look straight ahead, nothin?but blue skies

I can see clearly now, the rain is gone,

I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright), bright (bright) Sun-Shiny day.

Been a while since I quoted some lyrics in my blog. But why not? I'm in a great mood. My MFI portfolio shot up 1.6% today... don't ask me why as the market wasn't up like that. Then I am off to San Francisco tomorrow. Always great to see the city by the bay ("Sitting on the dock of the Bay...").

Saw a very interesting note from Mr Greenblatt today (Greenblatt eyes Claire's, Autozone, Aeropostale). Readers may recall that I uncovered a recording from last December where JG recommended Autozone, Lexmark & The Gap from his MFI list. If you had bought those three back then you'd be up 28%. Like the old EF Hutton commercials, when Joel Greenblatt talks... we should listen. And so I did, I bought CLE at $27.50 today. It will not be part of my MFI portfolio as (1) I don't want to add more stocks and (2) I wanted to buy more than "normal". It is in my "Sidecar" portfolio. I sold my ASEI in the sidecar today after a 20% gain in the past week.

A bunch of my laggards were great today:

- ORCT + 8.4%

- EZEN +5.4%

- TBL +6.2%

- HW +3.1%

| Current Portfolio | |||

| Stock | Cost | Current | Gain |

| PNCL | $6.68 | $9.69 | 45.1% |

| UST | $39.36 | $54.51 | 42.8% |

| ASEI | $45.85 | $63.31 | 38.1% |

| TGIS | $10.34 | $13.64 | 33.8% |

| MSTR | $94.36 | $125.02 | 32.5% |

| ANF | $61.13 | $74.38 | 22.2% |

| BBSI | $19.56 | $23.22 | 18.7% |

| CHKE | $37.55 | $43.00 | 17.7% |

| ELX | $17.85 | $19.99 | 12.0% |

| MGLN | $38.34 | $42.86 | 11.8% |

| MTEX | $13.11 | $14.46 | 11.5% |

| PGI | $7.71 | $8.28 | 7.4% |

| VPHM | $11.80 | $12.30 | 4.2% |

| FTO | $28.76 | $29.43 | 2.5% |

| BLDR | $15.91 | $16.26 | 2.2% |

| ISNS | $13.17 | $13.11 | -0.5% |

| RAIL | $58.18 | $55.16 | -5.1% |

| PTEN | $26.72 | $25.22 | -5.2% |

| KG | $17.31 | $16.18 | -6.5% |

| DLX | $26.36 | $23.89 | -6.9% |

| TBL | $34.50 | $31.74 | -8.0% |

| TRLG | $17.02 | $15.47 | -9.1% |

| PACR | $32.53 | $29.25 | -9.2% |

| PONR | $30.98 | $26.91 | -13.1% |

| ORCT | $11.83 | $9.58 | -19.0% |

| HW | $33.04 | $22.66 | -31.4% |

| FDG | $34.03 | $19.80 | -37.1% |

| EZEN | $2.84 | $1.74 | -38.6% |

| OVTI | $27.79 | $16.41 | -40.9% |

| Current Gain/Loss ($) | $5,897 | ||

| Current Gain/Loss (%) | 1.8% | ||

| Sold Gain/Loss ($) | $10,050 | ||

| Sold Gain/Loss (%) | 25.0% | ||

| Total Gain/Loss ($) | $15,947 | ||

| Benchmark Gain/Loss ($) | $24,764 | ||

| Annual IRR | 10.1% | ||

| Total Gain/Loss (%) | 5.0% | ||

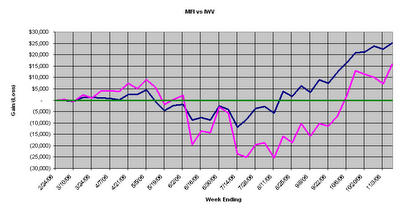

A recap for newer readers. I have sold 5 MFI stocks: IVII, NCOG, NSS, PTSC & PCU. The 1st three were bought by other companies. I decided PTSC really wasn't an MFI stock (and frankly I could not stand the volaility). Then PCU had been called an MFI stock by me at the start but was in my normal portfolio already. I only counted the gains from when I started MFI. Here is my weekly graph. Remember for new readers that the blue line represents the change in the benchmark investment since Feb 24th. The Magenta line is my MFI portfolio of 29 stocks. The green line represents breakeven. I think you'll agree that the trend is my friend:

No comments:

Post a Comment