ASEI was up 5% and is now up a snappy 22%.

FDG was up 6% as it made a mini comeback from the Canadian bloodbath.

PTEN and FTO reflected the bullish Energy mood going up 4% each.

I think I finally understand why UST dropped $3 on the 26th after very good earnings. Read this report:

"While cigarettes have long been this blue chip's cash crop, the company announced during the third quarter that it's test-marketing a smoke-free and spit-free tobacco product called Taboka. Taboka, which Altria developed on its own,is being test-marketed in the Indianapolis area. While cigarette sales have been declining nationally at a rate of 2% to 3% annually, the sales of smokeless tobacco products have been growing 4% to 5% per year.

I think the foray into the smokeless tobacco market indicates that Altria is in touch with national trends and hasn't grown complacent. The move should also bring added heat to competitors Reynolds American and UST (NYSE: UST - News), which control the lion's share of the market."

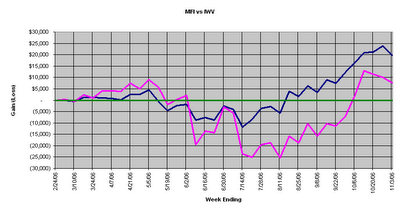

Here are my most recent charts and stats. I did finally figure out why my graph and table were out of sync. I was double counting dividends in the table for IWV.| Current Portfolio | |||

| Stock | Cost | Current | Gain |

| UST | $39.36 | $53.12 | 39.3% |

| TGIS | $10.34 | $12.90 | 26.6% |

| MSTR | $94.36 | $118.91 | 26.0% |

| PNCL | $6.68 | $8.29 | 24.1% |

| ASEI | $45.85 | $56.01 | 22.2% |

| TRLG | $17.02 | $20.69 | 21.6% |

| ANF | $61.13 | $72.57 | 19.3% |

| MGLN | $38.34 | $43.24 | 12.8% |

| MTEX | $13.11 | $14.61 | 12.7% |

| VPHM | $11.80 | $12.94 | 9.7% |

| BBSI | $19.56 | $21.30 | 8.9% |

| CHKE | $37.55 | $39.64 | 8.8% |

| FTO | $28.76 | $31.11 | 8.4% |

| ELX | $17.85 | $19.26 | 7.9% |

| PGI | $7.71 | $8.24 | 6.9% |

| ISNS | $13.17 | $12.98 | -1.4% |

| BLDR | $15.91 | $15.47 | -2.7% |

| KG | $17.31 | $16.20 | -6.4% |

| RAIL | $58.18 | $53.34 | -8.3% |

| PACR | $32.53 | $28.95 | -10.1% |

| PTEN | $26.72 | $23.83 | -10.4% |

| DLX | $26.36 | $22.44 | -12.4% |

| PONR | $30.98 | $26.46 | -14.6% |

| TBL | $34.50 | $28.43 | -17.6% |

| HW | $33.04 | $24.54 | -25.7% |

| ORCT | $11.83 | $8.57 | -27.6% |

| FDG | $34.03 | $22.42 | -29.4% |

| EZEN | $2.84 | $1.70 | -40.0% |

| OVTI | $27.79 | $15.98 | -42.5% |

| Current Gain/Loss ($) | -$2,369 | ||

| Current Gain/Loss (%) | -0.7% | ||

| Sold Gain/Loss ($) | $10,050 | ||

| Sold Gain/Loss (%) | 25.0% | ||

| Total Gain/Loss ($) | $7,681 | ||

| Benchmark Gain/Loss ($) | $19,729 | ||

| Annual IRR | 4.8% | ||

| Total Gain/Loss (%) | 2.4% | ||

No comments:

Post a Comment