Final post for a few days. Taking the family to New Hampshire and then Boston for the 4th of July. Hopefully all the rain will clear out. Still giddy from the big day yesterday. Maybe this MFI thing will work out.

Final post for a few days. Taking the family to New Hampshire and then Boston for the 4th of July. Hopefully all the rain will clear out. Still giddy from the big day yesterday. Maybe this MFI thing will work out.I did watch some of the financial news this morning. I guess there was a key phrase removed from the Fed wording and that was the reason for the explosion upwards. With the MFI portfolio, I at least know what to do... nothing. With the rest of my portfolio... I am unsure. Jubak said to sell into rallies, he thinks the malaise will be with us throughout the summer. I will probably roll my 401K into cash today.

Here are some quotes from economists about the statement yesterday:

- "Both the structure and language of the statement are more dovish than in May and are perhaps surprising -- pleasantly -- in the light of the recent round of speeches from Fed officials."

- "We find ourselves in a tight spot. We have been arguing that the Fed will pause in August and, while one can find elements of this statement to support such a view, it seems clear to us that the data will have to shift to allow it."

- "Our view is that the Fed will stop hiking rates but there is still a burden on the economic data to indicate that recently high inflation readings were temporary. "

- "We judge this statement as consistent with the Fed moving the funds rate to 5.5% in the third quarter, however, we think the markets had gotten ahead of the Fed when they were pricing in a 86% probability of an August rate hike."

All this reminds me of the joke about economics. "Why was astrology invented? So that economics would be considered an accurate science."

MGLN - This has been one of my best performers, up about 17%. Magellan Healthcare just bought another company, but interestingly that caused their price to go up (Magellan Health Services to Acquire ICORE Healthcare). I do have a new nickname for Magellan - I'm Gellin' from those Dr Scholl's commercials.

Warning Waring Warning! The following section contains graphic violence!

Ouch. DLX crashed and burned today. It was chugging along kind of nicely today, up 2.5% when BAM! They announced all kinds of negative stuff (Deluxe Crashes and Burns):

1. They are abandoning a software project

2. They have performance shortfalls in each segment and

3. They have initiatives to improve cost structure.

The CEO also commented on impacts to corresponding cash flows. That can mean only one thing... a drop in their $1.60 dividend. Ouch.. again. DLX is now down almost 10%. It was strange, the announcement was at 2 pm rather than before or after market hours. If you had been on the ball and read this announcement quickly, you could have gotten out before the stampede for the exits began.

That means I have 3 stocks that have crashed and burned of my 28. HW and TBL also announced significant earning shortfalls. All three are down tons for me. DLX: -25%. HW: -32% and TBL: -22%. It does show that JG's approach of assuming that the past 12 month earnings is a good proxy for future is not without flaws. I will hold the stocks per the MFI approach, though I am sorely tempted to sell DLX as I expect it'll take another tumble when the dividend is axed. Wow, as I type, other people are figuring out the same thing and now DLX is down 17%. Heck, after that it'll probably still be on the MFI list.

In fact that raises an interesting point. If DLX is still on the list say at year end, would I be wise to continue to hold DLX? They do have a new CEO and he does seem to be taking some aggressive action. Perhaps it will be a turnaround play for those who are patient. Or should I sell now for the tax write off and buy back in 30+ days assuming it'll still be around? Not by the rules, but perhaps such a move makes sense... I do need some ST capital losses. Hmmm, no I says. I plays by the rules. For better or for worse. For richer or for (true in this case?) poorer. It is a shame as today was shaping up like such a good day, I was actually getting close to passing IWV.

Let us see what happened to HW & TBL post their C&B.

HW announced shortfall on May 18th. They dropped from $31.40 to $28.87. They are now at $25.54. Wow.

TBL announced shortfall on May 2nd. They fell from $34.56 to $30.82. They are now $27.09. Wow-wow.

There is precedent that it might be better to sell now. Hmmm. What do you think? Would you forgive me if I broke the rules?

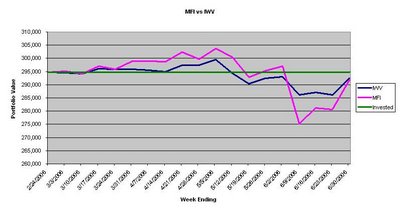

Finally, here is weekly graph of my portfolio performance. Despite DLX, it was a nice week. Remember, the green line is my total investment (ie breakeven), blue is the benchmark IWV and magenta is my portfolio.