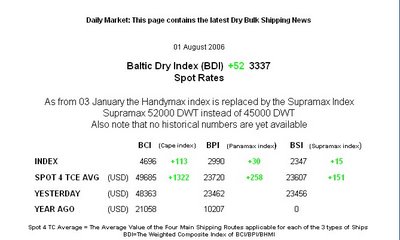

One item I look at regularly is shipping rates. Studies have been performed that show shipping rates are a great measure of the world economy as they show the demand for bulk goods and manufactured goods earlier in the supply chain. The table to the left shows what they have be doing of late and the answer is that they have been going through the roof. They have actually more than doubled in the past 12 months!

One item I look at regularly is shipping rates. Studies have been performed that show shipping rates are a great measure of the world economy as they show the demand for bulk goods and manufactured goods earlier in the supply chain. The table to the left shows what they have be doing of late and the answer is that they have been going through the roof. They have actually more than doubled in the past 12 months!I am not sure what to do with this information. I am kicking around the idea of buying a shipping stock as their pricies don't seem to reflect this increase. MFI used to have a few shipping stocks, but they have (ahem) sank from sight.

The other area I am kicking around is to actually buy a Pharma stock. TEVA is the one I am really tempted by as it has been hammered (around $33). In part because of the Israeli war, in part because of battles with MRK. But all the Pharmas have been posting solid numbers, in part (as Cramer noted) that the new Medicare subsidies are allowing seniors to afford more drugs. I suppose another option is BVF. This is an MFI stock that has dropped under $21. Their chairman is in the news for alledgedly not disclosing 12 million shares of BVF held in a trust. If it can be shown that those shares were bought/sold at opportune times that might not be pretty. That being said, this might be a buying opportunity as the company itself seems to be clicking.

Hmmm, time for MFI #30?

Big Time W-H-E-W-!!!

At lunch time I snuck a peak at BVF, down 21% today! They lost a court battle regarding a patent (Biovail Shares Plummet on Court Ruling). I will tell you, investing in these MFI stocks at times seems a bit akin to Russian Roulette. Maybe other stocks have these things happen as well, but it seems more common in the MFI world. Glad I didn't buy. TEVA is looking better, up 3% today but still very cheap. But I suspect I'll wait.

Looks like the market was unimpressed with PACR earnings, down 29 cents as I type to $29.15. ORCT is my big gainer again, up over 7%. Up to $8.50 from $6.75 just during past week. People are finally recognizing ORCT had been oversold. IMHO, still has a long ways to go, especially with any positive news at all.

The day is done, watching the silly "America's Got Talent". It is a mindless show. Nice day for my portfolio, up a notch over 1%. We're now down 5.2%.

| Stock | Cost | Current | Gain |

| NCOG | $19.39 | $27.05 | 39.5% |

| UST | $39.36 | $50.67 | 31.6% |

| PCU | $78.13 | $96.52 | 29.6% |

| MGLN | $38.34 | $48.18 | 25.7% |

| FTO | $28.76 | $35.38 | 23.1% |

| MTEX | $13.11 | $14.46 | 10.9% |

| NSS | $45.89 | $49.31 | 7.5% |

| TRLG | $17.02 | $17.64 | 3.6% |

| CHKE | $37.55 | $38.03 | 2.9% |

| PTEN | $27.74 | $28.23 | 2.1% |

| ISNS | $13.17 | $13.24 | 0.5% |

| KG | $17.31 | $17.25 | -0.3% |

| TGIS | $10.34 | $9.85 | -3.6% |

| PGI | $7.71 | $7.42 | -3.8% |

| EZEN.ob | $2.84 | $2.70 | -4.8% |

| RAIL | $58.18 | $54.14 | -6.9% |

| MSTR | $94.36 | $85.93 | -8.9% |

| PNCL | $6.68 | $6.05 | -9.4% |

| IVII | $10.93 | $9.86 | -9.8% |

| PACR | $32.53 | $29.04 | -9.8% |

| FDG | $34.03 | $28.63 | -13.3% |

| ANF | $61.13 | $52.61 | -13.7% |

| ELX | $17.85 | $14.91 | -16.5% |

| PONR | $32.97 | $26.69 | -19.0% |

| ORCT | $11.83 | $8.89 | -24.9% |

| TBL | $34.50 | $25.54 | -26.0% |

| PTSC.OB | $1.31 | $0.88 | -32.8% |

| OVTI | $27.79 | $18.42 | -33.7% |

| DLX | $26.36 | $16.72 | -35.1% |

| HW | $37.42 | $23.22 | -37.9% |

| Total Gain/Loss | -$15,892 | ||

| Benchmark Gain/Loss | -$1,979 | ||

No comments:

Post a Comment