I often scratch my head, not understanding why stocks move the way they do post-earnings. I have done so publicly in this blog from time-to-time. The only thought I have is that often people do not really expect the analyst estimated earnings and revenues, instead they expect something unexpected. I suppose this is the so-called "whisper-number", though certainly no one has whispered anything to me.

I often scratch my head, not understanding why stocks move the way they do post-earnings. I have done so publicly in this blog from time-to-time. The only thought I have is that often people do not really expect the analyst estimated earnings and revenues, instead they expect something unexpected. I suppose this is the so-called "whisper-number", though certainly no one has whispered anything to me.ANF is a prime example this afternoon. They announced their earnings just now (Abercrombie & Fitch Reports Second Quarter Results). I read through the release and frankly they looked "normal". Beat earnings per share by a penny. Revenues seemed right on. Guidance for rest of year seemed spot on. Now after-hours ANF is up almost $4. Trust me, I am not complaining. Why the pop? Either I am missing something in the release (always possible) or people were pessimistic and now realize everything is hunky-dory.

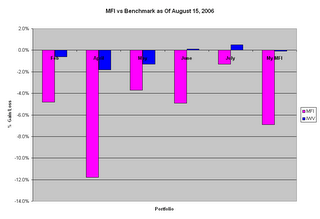

Here is an update on hypothetical portfolios - I set one up every month.

Here is an update on hypothetical portfolios - I set one up every month.Feb 2006: -4.8% (benchmark: -0.6%)

April 2006: -11.8% (benchmark: -1.8%)

May 2006: -3.7% (benchmark: -1.3%)

June 2006: -4.9% (benchmark: +0.1%)

July 2006: -1.3% (benchmark: +0.5%)

Me: -6.9% (benchmark: -0.1%).

I sure knows how to picks stocks purty well! My end of May stocks (The Select Seven) have really hurt me. They are down almost 6.5%. The 5 stocks I didn't pick are up about 2% on average (KSWS, AESI, AGYS, VTRU & FTD {I was so wrong about FTD, +28%!}). Humbling? Yes! Looking in the rear view mirror often is.

Great day in the market. I suppose the market is starting to believe that BB is done raising rates. My MFI portfolio went up about 1.5%, so I made a little headway on the green line. The benchmark IWV was up as well and is just about at break-even. I have two weeks until I have been at this game for 6 months. I would l-oooooo-ve to be at break-even then!

No comments:

Post a Comment