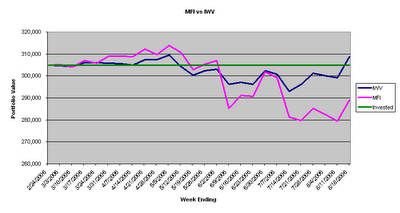

First Friday in 3 weeks that I'll be posting my soon to be infamous MFI graph. For those first-timers out there, the graph monitors my MFI portfolio performance (29 stocks). It assumes $10,000 in each stock, with the exception of 7 stocks which have $12,000. So total invested in portrayed by the so-called "Green Line", which for those mathematically challenged = $304,000.

First Friday in 3 weeks that I'll be posting my soon to be infamous MFI graph. For those first-timers out there, the graph monitors my MFI portfolio performance (29 stocks). It assumes $10,000 in each stock, with the exception of 7 stocks which have $12,000. So total invested in portrayed by the so-called "Green Line", which for those mathematically challenged = $304,000.There is the so-called "Magenta Line" which tracks the value of my portfolio week-by-week. It does include dividends the date the stock goes ex-dividend (so DLX gets the 25 cent dividend in the chart today).

Finally, there is the so-called "Blue Line" which tracks the benchmark IWV portfolio with purchases of the benchmark coinsiding with the MFI purchases. The astute reader witll note that the Blue Line is on top, then the Green line and then finally the Magenta line. This is not the way a savvy investor wants the graph to look.

Good as Gold. Read an interesting article about Copper prices (Copper Lifts, Gold Slips), always read with interest due to PCU holdings. Copper prices are headed back up as several Chilean mines are closed do to work stoppages. None of the mines are affilaited with PCU (one is BHP as I recall). Bad for them, good for us.

Good as Gold. Read an interesting article about Copper prices (Copper Lifts, Gold Slips), always read with interest due to PCU holdings. Copper prices are headed back up as several Chilean mines are closed do to work stoppages. None of the mines are affilaited with PCU (one is BHP as I recall). Bad for them, good for us.My idea to buy a few beaten down MFI stocks for ST in my IRA has worked well in first few days. The three stocks (PONR, PTSC & TGIS) are up a composite 3.8%. Not getting me rich, but I'd take that week-in and week-out.

Had another confrontation in the MSN strategy lab today. Mr Dlugosch felt that the amatuer Mr Ko is wrong about housing stocks being ready to rebound. Here is what he said:

The housing market is the tip of the iceberg and should sound alarm bells. Recently, Thomas Ko wrote about Comstock Homebuilding (CHCI, news, msgs). I respectfully disagree with his assessment. This is a stock that should be sold and sold immediately.

The slowdown in housing has just begun. From past experience, this industry has a tendency to go through boom and bust cycles. Those that think housing is undervalued and oversold miss the point.

These companies can -- and have gone -- bankrupt when times were tough. The potential reward in Comstock Homebuilding does not merit taking the risk. It does not matter that book value is higher than the current stock price. If asset values are shrinking and new homes are not selling, Comstock Homebuilding with its overhead could be in trouble.

I don’t want to be an alarmist as I do think we will avoid catastrophe in the homebuilding sector. The problem is that it will take many years of adjustment to recover from the recent boom. There is clearly another leg down here in my opinion, and I am selling Comstock Homebuilding immediately.

I tend to agree with JD. I was talking to a friend selling his house in NH and he said that there are a lot of sellers and not many buyers. That will place a lot of pressure on the homebuilders. Higher interest rates could cause increased foreclosures as people were too leveraged, this could also dampen the market. That being said, Ko's stock CHCI (which JD owned until today and lost a bunch) is pretty beaten down... from over $14 to $4.88 YTD. Ow. Finally, if JD is so smart, why did he buy CHCI and HSOA (another housing-related stock) at the start of the contest 6 weeks ago? Fun to watch form the sidelines, I won't have the courage to wade into housing until the Fed starts dropping rates... though I do think things are still strong in certain markets like Texas.

Enough of that. I saw an amazing sight today! RAIL is back in the Green for me!! Yes I know, I had to pinch myself as well. See all these MFI stocks can do well, you just have to buy them at the right time. RAIL strayed furtherest off the tracks on July 21st when it hit $45.10. Today it has clickety-clacked back to $59.13. That is a 31% gain for those of you who don't have their HP 12C handy.

No comments:

Post a Comment