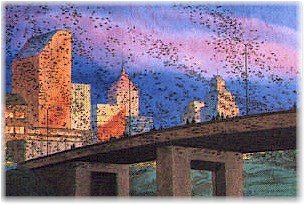

Well, the good news is that we're in Austin, Texas and finishing a great family vacation. Went to the famed Bat Bridge here last night and we were not disappointed, seeing the 1.5m bats stream out to eat their insects at dusk. They eat 30,000 to 40,000 lbs of insects a night. It was a real battle of nature as predator birds awaited the bats streaming out and then dove down for dinner. My favorite part of the narration was to estimate the number of bats they take a picture of a 5ft x 5ft picture and count the number of bats via a blown up picture. They do this for several weeks and then calculate the "batting" average. (groan).

Well, the good news is that we're in Austin, Texas and finishing a great family vacation. Went to the famed Bat Bridge here last night and we were not disappointed, seeing the 1.5m bats stream out to eat their insects at dusk. They eat 30,000 to 40,000 lbs of insects a night. It was a real battle of nature as predator birds awaited the bats streaming out and then dove down for dinner. My favorite part of the narration was to estimate the number of bats they take a picture of a 5ft x 5ft picture and count the number of bats via a blown up picture. They do this for several weeks and then calculate the "batting" average. (groan).The bad news is that my MFI portfolio did nada during the vacation. I am a depressing 8% in the hole. That is pretty bad. A bunch of MFI companies announced their earnings this past week, too numerous to list now. I will say that PONR is an absolute steal at $24. They had very solid earnings and proceded to drop. NSS is a bargain as well at $47. But what do I know?

Here is the bat(d) news:

| Stock | Cost | Current | Gain |

| NCOG | $19.39 | $27.05 | 39.5% |

| UST | $39.36 | $51.00 | 32.5% |

| FTO | $28.76 | $36.66 | 27.6% |

| MGLN | $38.34 | $47.69 | 24.4% |

| PCU | $78.13 | $88.43 | 19.3% |

| NSS | $45.89 | $46.81 | 2.0% |

| TRLG | $17.02 | $17.36 | 2.0% |

| CHKE | $37.55 | $37.07 | 0.3% |

| PGI | $7.71 | $7.73 | 0.3% |

| MTEX | $13.11 | $13.06 | 0.2% |

| PTEN | $27.74 | $26.90 | -2.7% |

| MSTR | $94.36 | $90.69 | -3.9% |

| KG | $17.31 | $16.49 | -4.7% |

| ISNS | $13.17 | $12.48 | -5.2% |

| PNCL | $6.68 | $6.27 | -6.1% |

| ANF | $61.13 | $55.47 | -9.0% |

| RAIL | $58.18 | $52.61 | -9.6% |

| FDG | $34.03 | $29.40 | -11.0% |

| IVII | $10.93 | $9.42 | -13.8% |

| ELX | $17.85 | $15.01 | -15.9% |

| TGIS | $10.34 | $8.38 | -17.8% |

| PACR | $32.53 | $26.11 | -18.8% |

| EZEN.ob | $2.84 | $2.28 | -19.6% |

| TBL | $34.50 | $26.31 | -23.7% |

| ORCT | $11.83 | $8.85 | -25.2% |

| PONR | $32.97 | $24.06 | -27.0% |

| DLX | $26.36 | $16.52 | -35.8% |

| PTSC.OB | $1.31 | $0.82 | -37.4% |

| OVTI | $27.79 | $17.13 | -38.4% |

| HW | $37.42 | $21.81 | -41.7% |

| Total Gain/Loss | -$25,355 | ||

| Benchmark Gain/Loss | -$5,497 | ||

| Annual IRR | -25.5% | ||

| Overall Gain/Loss | -8.3% | ||

No comments:

Post a Comment