I know, pretty obscure album by Leo Kottke... I'll bet most of you have never heard of it. I always loved the title though. Actually, I can barely remember any of the tracks myself, the last time I heard it was pre-CD on vinyl. Wait, I do remember a song... "Louise". A very sad song.

I know, pretty obscure album by Leo Kottke... I'll bet most of you have never heard of it. I always loved the title though. Actually, I can barely remember any of the tracks myself, the last time I heard it was pre-CD on vinyl. Wait, I do remember a song... "Louise". A very sad song."Sometimes a bottle of perfume, flowers and maybe some lace

Men brought Louise 10-cent trinkets

Their intentions were easily traced"

I think someone else sang it recently, maybe the Dixie Chicks or Bonnie Raitt.

But today even my feet are smiling. This was my 2nd best day of the year (MFI stocks up 2.2%). The best was June 29th, so it shows that volatility is really on the rise. I did mention yesterday that a lot of people were short and that a catalyst could ignite things. If we get decent numbers from MOT, AAPL etal tonight, I suspect we'll have another banner day tomorrow.

Here are some notes on my stocks

FDG - I was right last night. It was a mediocre quarter. FDG sold down 1.5% even with today's positive mood.

PTSC (+11.4%), MTEX (+9.1%) and OVTI (+5.2%) were my big gainers. PTSC and OVTI had really been oversold, so not a big surprise. I am stil waiting to see PTSC report on quarter closing May 31st. I am flummoxed, bamboozled, mystified and perplexed on where their report could possibly be.

With my gain today, I am now down 6.1% so far. In my large cap vs small cap race, small is winning the race down 2.7% vs 7.9% for large caps.

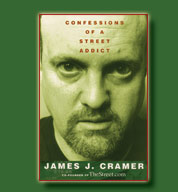

Cramer was pretty funny tonight. He made fun of chartists (a point we agree on). He spoke about how the market had a classic head and shoulders pattern and the proceded to shampoo his bald head with head & shoulders shampoo while listening to "Head, Shoulders, Knees and Toes". For a multi-millionaire, he is a wild & crazy guy!

I am not an economist, but this is my blog so here goes. Is anyone out there worried about foreclosure rates? Everyone keeps talking about how the high price of gas is pinching consumers. How much does an extra $ per gallon cost consumers? If you filled up once a week with 15 gallons that would be $15 per week.... say $70 per month.

But how about higher interest rates? I read where adjustable rate mortgages made up 30 to40% of loans in 2004. They were going 2 points below fixed loans, so say 2.5%. The current rate must now be at least 6.5%. If you borrowed 300K a 4 point hike would be about $12,000 a year or $1,000 a month. Now that is serious money compared to the $70 pop for gas. According to NPR, foreclosure rates are up 38% in the 2nd quarter of 2006. People who extended themselves too far in the housing gorge have to really be feeling the pinch, and if they just put 5 or 10% down, their home has dropped in value and the A.R.M.s are making the monthly payments hurt I gotta believe they just send the key to the banker and walk.

Enough doom and gloom on this mah-velous day. Take care!

No comments:

Post a Comment