I bought FORD (Forward Industries, not to be confused with the auto company) on an impulse yesterday... "muy rapido". It has been on the MFI list as long as I have been doing this. Last night I did a little research on FORD. I had discarded them as a "better idea" several times before.

I bought FORD (Forward Industries, not to be confused with the auto company) on an impulse yesterday... "muy rapido". It has been on the MFI list as long as I have been doing this. Last night I did a little research on FORD. I had discarded them as a "better idea" several times before.The problem is that they are dropping like a rock in sales. Sales have dropped from 11.2m in March-05 to 6.5m in March-06. Earnings before taxes and Interest (EBIT) has also dropped like a rock, and this is the single most important number for MFI. The stock price has fallen off the table, going from $29 to the current $5.90. The issue is that they had a big contract that is now in run-off and should be totally gone by year-end.

FORD does have a strong balance sheet, with $19.7m in cash and a market cap of $46m. All said and done, I don't think it is a terrible stock. However, MFI isn't appropriate for companies that had "one time" earning blips and I think that is the case here. I will be a seller today and will hopefully make a little money on my impulse. (PS - I sold FORD in extended trading this a.m. for $6.10, which means I did make a quick 5% on the trade. However, I will not be counting this as an MFI transaction).

I watched Mr. Cramer's son last night. He actually recommended NSS (Nice!) last night. Here is what Skeedaddy had to say: "This stock is unbelievable. ... makes steel welded products for energy ... sells at only eight times earnings. I think that opportunity would be knocking [if it goes] down a dollar." He does make me laugh... what is magical about the $1? If it is unbelievable it should be a good buy before dropping a buck.

Pretty funny, Blogger now has a word verification component for me. Whenever I save or publish I have to read their wiggly writing and verify it. Must be some hackers trying to overwhelm the Blogger systems. Don't these guys/gals have something more constructive to do?

I have identified a new company to watch for potential purchase (no I won't be trigger happy this time: "Fire, Aim, Ready!"). ISNS is about a 50m market cap. They make image sensors such as you might find on a traffic light or tunnel. Seems like a good business model and they are pretty cheap while growing about 20%. Plus they're based out of St Paul, you've got to trust the quiet people from Minnesota. Anyway, I have an alert if it drops below $13.10. We'll see, I do have that $ burning a hole in my pocket.

Zig when they say "Zag". I saw where PCU was upgraded by HSBC to "overweight" today. I looked at past analyst changes on the stock. Citigroup was terrible (do analysts have a clue???). On Monday, May 15th they upgraded PCU from a Hold to a Buy. The closing price on the 12th was $100.10. Then on June 8th they reversed themselves and went from Buy to Hold. On the 7th the closing price was $80.72. Nice call, just a 20% drop. Of course, since their downgrade, PCU is at $94 as I type. Wrong again, costing investors a potential 16% gain. Talk about being late to the party!

End of the day. Using my 20/20 hindsight mirror, I am glad I sold FORD early at $6.10 as it closed at $5.62. I did end up filling about 70% of my order for ISNS at $13.10. It is a very lightly traded stock. We'll see if next week I can fill out the rest.

Last thought of the day. I read a little bit about PTSC as I was wondering when they'll be reporting their most recent quarter. The answer to the question should be by the middle of next week as they have 45 days after May 31st. They are the Intellectual Property company and have been successful in upholding their patents. They only have 5 employees. They have a 50/50 JV with TPL to pursue the high tech companies. These companies are called Patent Trollers. One concern is that the actual key patent was by a man named Russell Fish. The SEC filing stated that Mr Fish is claiming he had not signed the patent rights over the PTSC. Could get ugly though PTSC says they believe the claims are false.

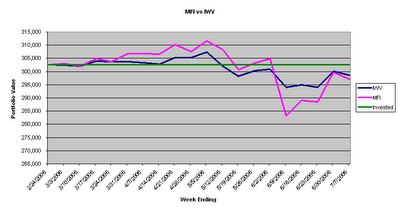

Time for my weekly graph. Not a pretty picture by the week. Even worse if you know that I actually had gotten above the blue benchmark Russell 3000 line during the week, only to fall $1,575 back as of now. I had also gotten within 2K of cash, but am now about $5.6K back.

No comments:

Post a Comment