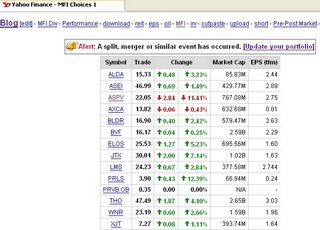

For those of you new to reading my blog, I have begun trying to identify potential stocks to buy from the MFI lists. Then I watch them for a buying opportunity. A couple of recent good examples have been BBSI & PRLS.

I began watching BBSI at around $21. I t dropped to $19.18 for no apparant reason and I pulled the trigger. So far that has been a great move as it is up 25% since then. PRLS had a so-so quarter. Their stock was punished, knocked down from $4 to $3 (it had been as high as $6 earlier in 2006). It then proceded to fall further (about $2.70). I did not pull the trigger in real life. Since then, it has shot to $3.90 in the past 3 weeks.

I am now watching ASPV. It went down 11% on Friday (to $22.05) as they announced a 3q shortfall. But (and this is the important part to me) they re-affirmed 2006 guidance (Aspreva Announces Preliminary Revenues for Third Quarter 2006 and Reaffirms Guidance for the Year).

Aspreva believes continued strong underlying annual growth of CellCept prescriptions in the range of 20%-25% will be realized in 2006. Aspreva is therefore reaffirming its previously disclosed guidance for revenue in excess of $200 million for 2006.

The stock is now dirt cheap. They are trading at 8x ttm earnings. If they drop at all next week, I may have to jump in. Not sure if they will be an "MFI" stock for me or just part of my non MFI holdings. I do want to keep # of stocks in that portfolio to 30. Now if I sell PTSC (a real possibility) then that would open a slot for ASPV.

1 comment:

MG,

Take a look at the Foolish article om ASPV:

http://www.fool.com/News/mft/2006/mft06101622.htm

Any thoughts, will you pull the trigger before November?

-Nick

Post a Comment