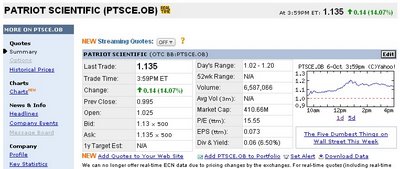

It was quite a day (up 14%) and quite a week for PTSC. Over the week it went from 85 cents to $1.13. I suppose people are becoming bullish about next Friday's earnng release. I did sell my side car PTSC stock (which I had bought for about 77 cents). I have done very well watching these smaller cap stocks (TGIS, EZEN & PTSC) and buying them on major dips in my retirement account for short term gains.

Jim Jubak now thinks we're set for a major 4th quarter rally (4th Quarter Rally). Music to my ears.

RAIL has dropped about 15% in the past month. It is now clear why (Amaranth Liquidates Holdings in 10 Cos.). This is the hedge fund (still don't understand why people invest with these funds) that all but blew up due to large bets on NG prices. I would view this as a great buying opportunity for RAIL as I am sure these were forced sales to a large extent. Let us look at the other 10 companies. Never mind. Besides RAIL, these seem to be tiny companies.

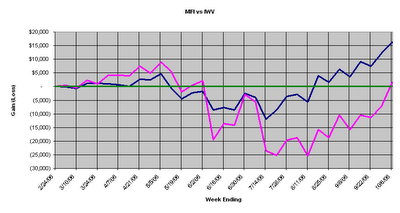

Here is my weekly graph. It is quite exciting!

No comments:

Post a Comment