Herd Followers - don't you hate it when an analyst downgrades a stock after sub-par earnings? After that the stock has already dropped in price. Pru did that with TBL the other day. Market totally shrugged it off as meaningless. Smart Money did a study. They found that when an analyst changes earnings away from the herd that it is a strong leading indicator. Kind of makes sense as an analyst needs to be pretty darned sure when making a change away from the herd.

Herd Followers - don't you hate it when an analyst downgrades a stock after sub-par earnings? After that the stock has already dropped in price. Pru did that with TBL the other day. Market totally shrugged it off as meaningless. Smart Money did a study. They found that when an analyst changes earnings away from the herd that it is a strong leading indicator. Kind of makes sense as an analyst needs to be pretty darned sure when making a change away from the herd.Deluxe Embarrassment - wow, DLX had their earnings last week and I didn't even notice. Sorry guys! Stock is pushing $23. You could've bought DLX for $13 in July. Proves that even boring old economy stocks can give good gains in MFI.

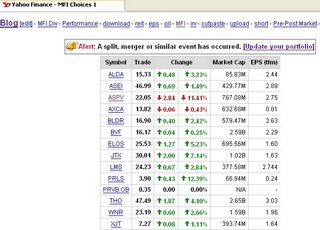

No Stock #30 - I decided against buying a 30th MFI stock. Instead I have plowed my proceeds from PTSC (sure glad I sold 'em) into more BLDR & BBSI. I am basically moving my most recent MFI purchases to my new tier of $ per stock as I try to pare down to 20-25 stocks over the next year.

ORCT - My lone Israeli stock made 6 cents today. They gave pretty lackluster guidance through April 2007. I don't know, if I have to sell a single MFI stock for tax purposes before December 31st, ORCT seems like a strong candidate. It has also entirely disappeared from any MFI lists.

IS Not Sweet - ISNS reported earnings in the middle of the day on Monday. That never works out well for me it seems. They were pretty bad. The company has now made less $ in 1st 9 months of 2006 vs 2005. Not a great sign. The problem is that these microcap companies are so lumpy in their earnings. The stock dropped about 12%. Funny though, some fool bought some shares at $14 about an hour after the news was released and the stock was trading at $13.

It has been an uneventful week so far. Made a little money Monday & Tuesday, but more or less treading water. Take care! Happy Halloween!